AI-powered, insurance-backed valuations for hard assets. Barker helps financial institutions lend with confidence by eliminating uncertainty.

Partner with Barker“Barker’s product is key to the financialization of the sector.”

“Unreliable asset data can lead to unpredictable risks. Barker fixes that.”

“Barker’s product is key to the financialization of the sector.”

“Unreliable asset data can lead to unpredictable risks. Barker fixes that.”

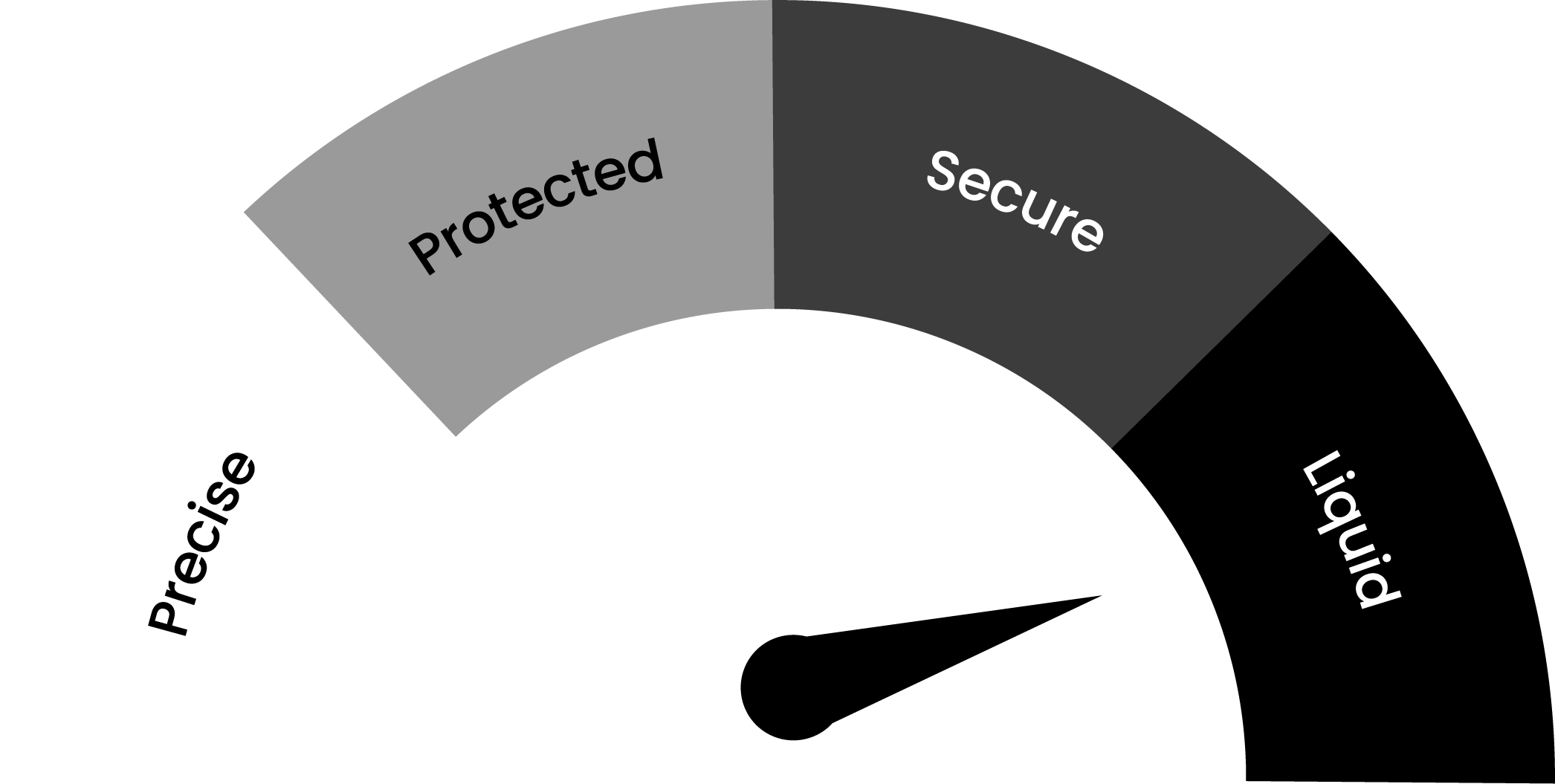

Traditional valuations provide untrustworthy asset prices, leading to defensive loan terms despite inherent value.

Prices can be trusted, hard assets are transformed into liquid capital.

Structured intake through our secure platform.

Not client data, just asset details.

Structured intake through our secure platform.

Not client data, just asset details.

“At White Bridge Capital, we envision a world where capital flows seamlessly toward transformative opportunities. In partnership with Barker, we’re expanding what’s possible for our clients—unlocking new frontiers across the global wealth management space.”

Tommy Campbell, Managing Partner, White Bridge Capital

“As a lender specializing in commercial transportation assets, finding qualified borrowers was always challenging. Since joining the network, we’ve increased our deal flow by 40% while reducing our lead acquisition costs significantly.”

Asset-Based Lender

“After struggling to get fair valuations on our specialized manufacturing equipment from traditional banks, The Specialty Lending Network connected us with a lender who understood the true value of our assets. We secured financing at 75% LTV instead of the 40% offered elsewhere.”

Manufacturing Company Owner

As demand for asset-backed lending and specialty financing continues to grow, one challenge has persisted: how to accurately value loan collateral that is increasingly hard to price. This challenge results in lenders acting defensively, offering lower loan to values and worse terms over more concrete collateral.

Be one of the first to use our new product. Join our community of testers today!